What is Foreign Exchange Rate and How is it Calculated?

18 March 2025

The Two Types of Exchange Rates

Flexible Exchange Rates

Most developed countries use flexible exchange rates based on supply and demand. They are adjusted based on changes to the economy. This means that if the demand for a currency is high, its value will increase. Lower foreign exchange rates mean imported goods are more expensive, which has a negative effect on the economy.

Fixed Exchange Rates

The governments of some countries set and maintain official exchange rates, which is usually set against major currencies; often USD. According to clear currency, the central bank in these countries “buy and sell their currency on the forex market in exchange for the currency it’s compared against.” In less economically powerful countries, this method allows more flow of currency, which attracts foreign investment.

How are Foreign Exchange Rates Calculated?

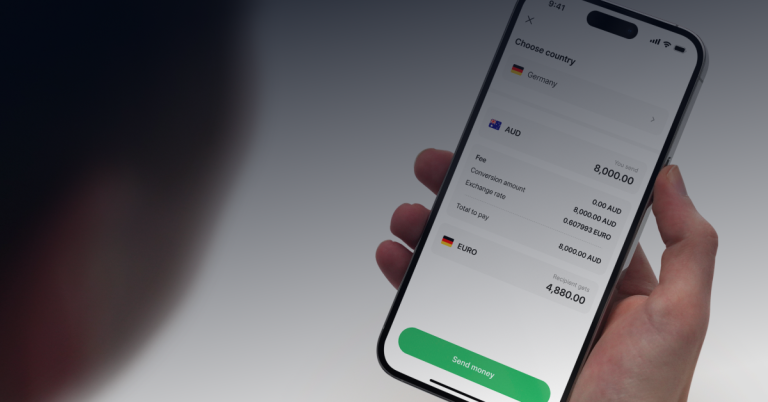

To find out the actual foreign exchange rate, you need to determine what your current local currency is worth in another currency. This is a simple calculation: the starting figure (in the local currency, divided by the final number (in the new currency) is the exchange rate. For example, you are sending $1000 AUD to the USA, and your recipient gets $659 USD, the exchange rate is 0.659. You can use the calculator on the e-Pocket remittance page to do such calculations.

But staying up to date on the value of one currency in relation to another is difficult. It is important to understand that foreign exchange rates are constantly changing. That is to say, they change during the day, usually on multiple occasions. This is due to the fact that foreign exchange rates are affected by demand levels, which fluctuate throughout the day. Naturally, this makes predicting changes extremely difficult to do, especially when you are trying to predict more preferable rates.

When you research and compare exchange rates with different banks and remittance companies, you are almost always not seeing the real exchange rates. This is because these institutions make significant profits off markups. It is therefore advisable to research as many companies as you can when sending money overseas. e-Pocket, for example, offers very competitive exchange rates and very low fees when you send money to any of the 100+ countries on our platform.

What is the Forex Market?

The foreign exchange (forex) market is the largest financial market in the entire world. The forex market is made up of various financial institutions like banks, commercial companies, central banks, hedge funds and many more. According to Investopedia, “The forex market allows participants, such as banks and individuals, to buy, sell or exchange currencies for both hedging and speculative purposes.”

The forex market is an over-the-counter (OTC) market which means trading does not revolve around a specific, centralised exchange. Large banks regularly trade currencies amongst themselves.

Other Factors that Affect Foreign Exchange Rates

Inflation

You should keep in mind that inflation is very closely related to exchange rates, and has a significant impact on them. As explained by Airwallex: “A reduction in an exchange rate often leads to inflation. So, if your local currency decreases in value, the cost of imported goods and services will likely increase. This drives up local prices, which causes inflation.”

Economic Performance

Broadly speaking, foreign investors invest their capital in countries with stable and thriving economies, which helps improve the exchange rate position of the country.

Interest Rates

When interest rates rise in a given country, and have higher returns relative to other countries, it is easier to attract foreign capital. This usually causes the exchange rate to rise.

Finding the Best Foreign Exchange Rates

There are different ways to find the exchange rate between currency pairs. You can learn more about money pairs in our Mid-Market Exchange Rate blog.

You can visit money exchange websites, big banks websites, fintech money transfer platforms, or even consult money service providers.

Trade

An increase in demand for exports leads to a higher exchange rate.

Public Debt

When a nation has large public deficits and debts, it becomes less attractive to foreign investors. This drops the exchange rate.

Current Account Deficits

When a country’s current account has a deficit, it naturally has a higher demand for the foreign currencies it receives through sales and exports. In this situation, it will also be supplying more of its own currency than foreigners will demand for their products.

What is a Restricted Currency?

A restricted currency, which you may also know as a blocked or a non-competitive currency is, according to kantox, “the monetary unit of a country where holders of the currency do not have the right to convert it freely at the going exchange rate into any other currency.”

The North Korean won and the Chilean peso are examples of restricted currencies.

Conclusion

It is very helpful to understand the factors that influence foreign exchange rates. When armed with strategies to find the best exchange rates, you increase your chances of finding a good deal when sending money overseas.

You can send money overseas at extremely competitive exchange rates with e-Pocket.

To learn more about sending money overseas from Australia, take a look at the e-Pocket blog page and read our Mid-Market Exchange Rate blog.